Equities ESG Assessment Agent

Revolutionising ESG Analysis with Advanced Automation and Data-driven Insights.

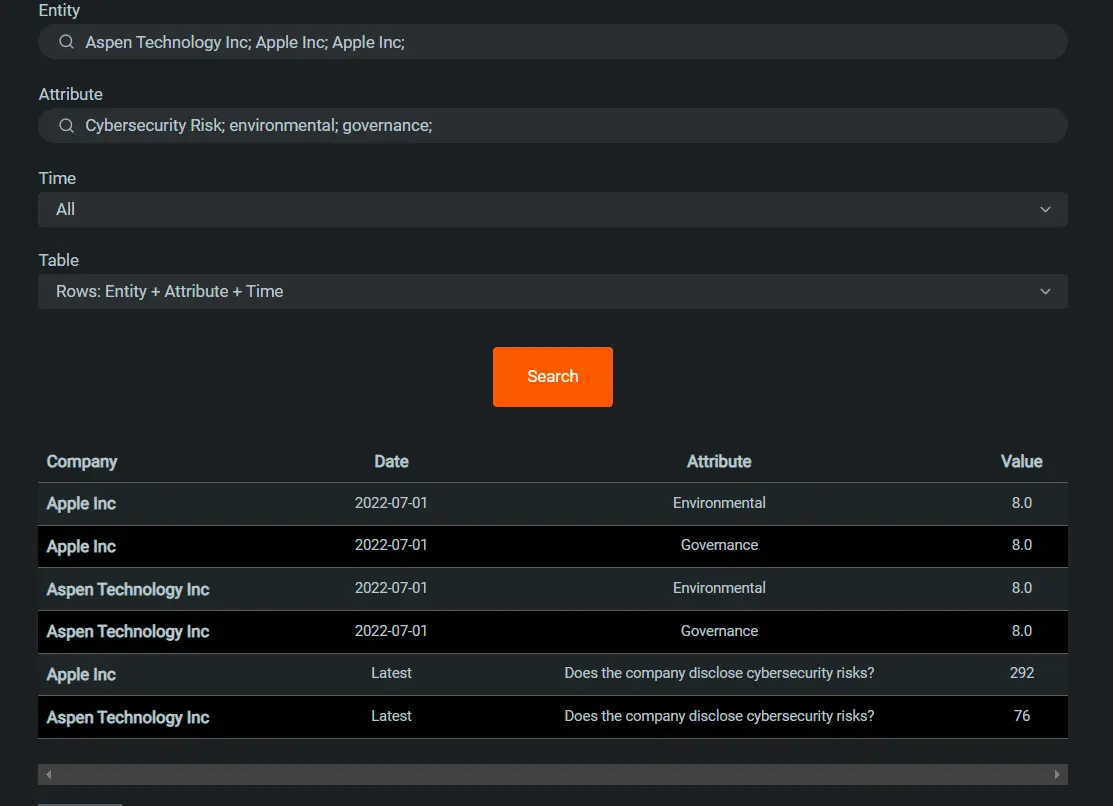

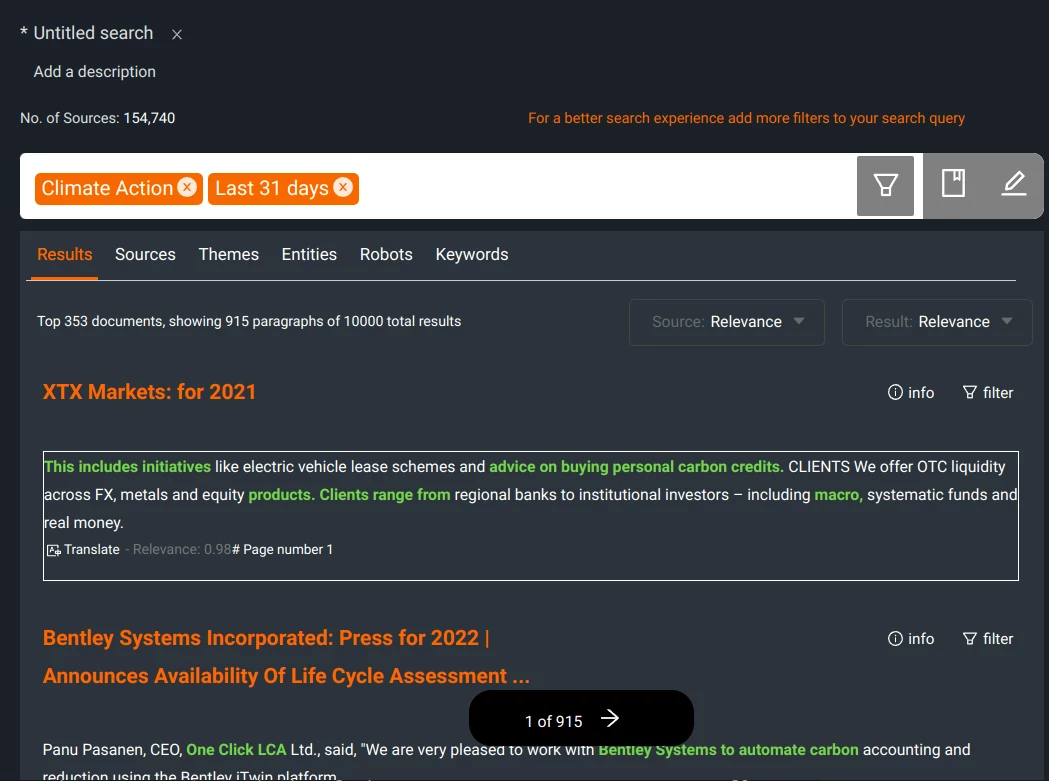

Are you an equity investment professional tired of manually sifting through mountains of public disclosures to retrieve ESG information and manually entering it into a scorecard? The Equities ESG Assessment Agent is a start-of-the-art application for automating your entire workflow for getting the required data and finalising your scorecard. Cognitive Robots retrieve the ESG information you need directly from the primary data sources relevant to public and private equities including annual reports, sustainability reports and earnings transcripts, and you can specify the framework logic directly within the application without needing to write any code. Get the outputs in an intuitive interface or directly via API to your internal system. This powerhouse application not only multiplies your productivity by up to 10x but also drastically expands your securities coverage and data point range.

Available Features:

Over 1,000 Cognitive Robots: Harness the power of specialised robots for ESG data extraction.

Customisable Robots: Get bespoke cognitive robots tailored to your unique requirements.

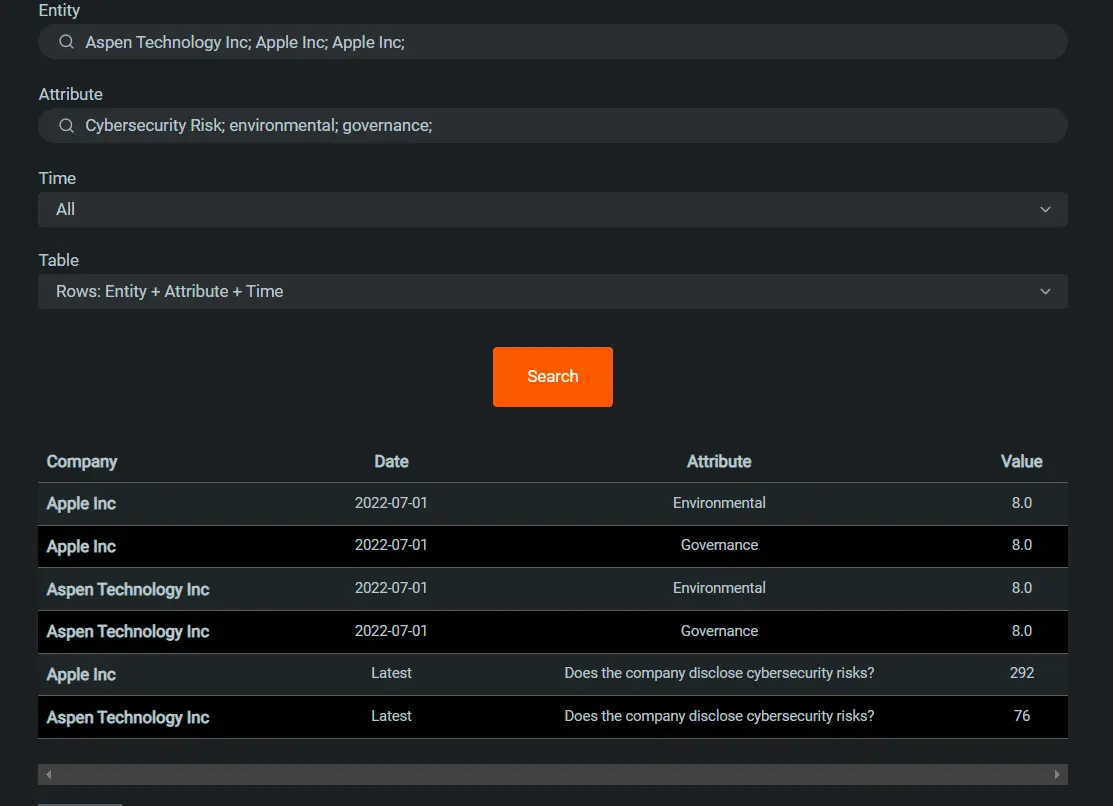

No-Code Scorecard Builder: Custom-fit scorecard outputs to match your preferred scoring methodologies using Sevva.

Transparent Audit Trails: Every data point traceable to its original source with paragraph-level precision.

Data-Driven Insights: Leverage a vast data lake with over 2 trillion AI inferences.

Global Reach: Comprehensive data covering all 70,000 listed companies around the world in any language

Real-Time API Access: Seamless integration with your current systems.

Who is it for?

Ideal for Heads of Investment Research, Investment Research Analysts, Equity Portfolio Managers, Sustainability Analysts, and ESG Analysts seeking to elevate their ESG assessment process.

Benefits:

Enhanced Productivity: Save hundreds of hours and boost your workflow efficiency with automated data extraction.

Robust Returns: Boost portfolio alpha by basing your investments on actionable ESG insights.

Stay Compliant: Effortlessly meet and exceed ESG regulations with up-to-date, comprehensive data.

Increase AUM: Drive more Assets Under Management (AUM) with a sharpened ESG focus.

Competitive Edge: Stay ahead of the curve by covering a broader range of companies and incorporating diverse data points.

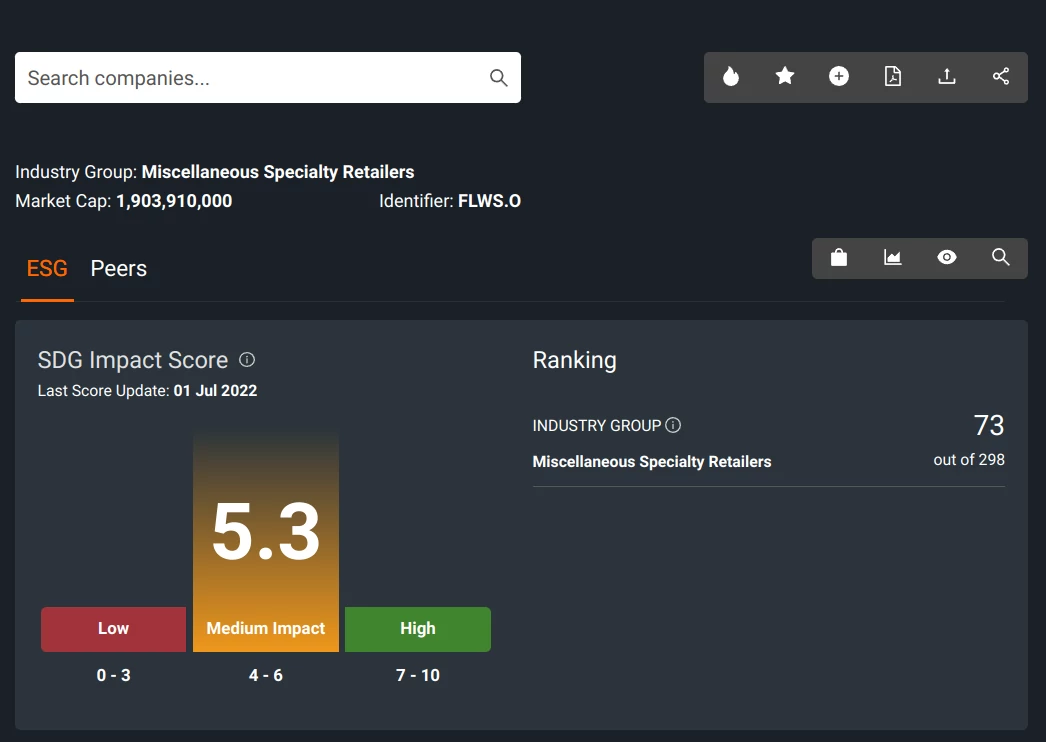

Gallery

- Automate ESG Analysis Workflow

- Ensure Compliance

- Data for the entire Capital Market