Portfolio Climate Governance Agent

Streamlining Climate Governance Analysis with Efficient Automation and Data-Centric Understanding.

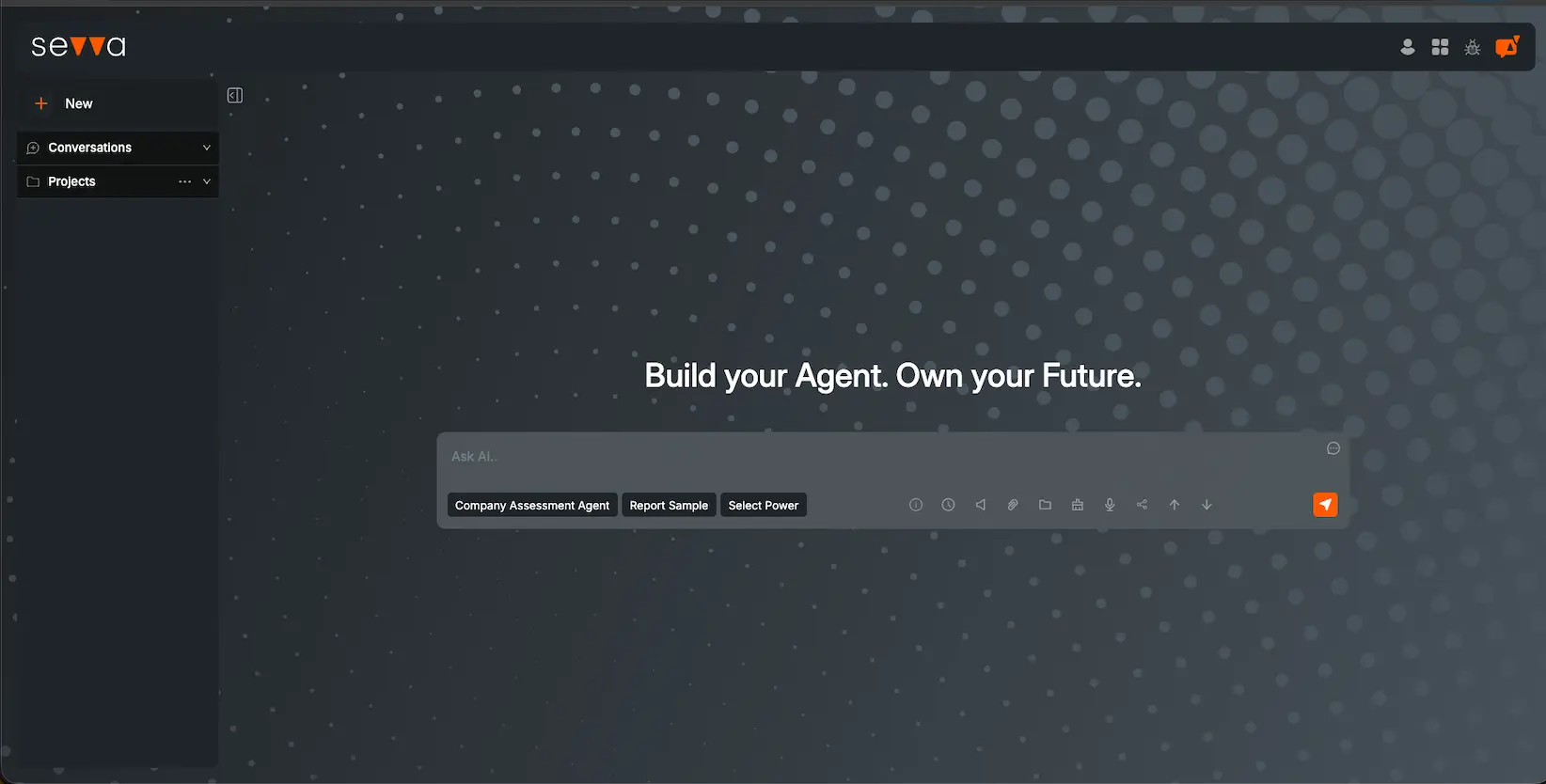

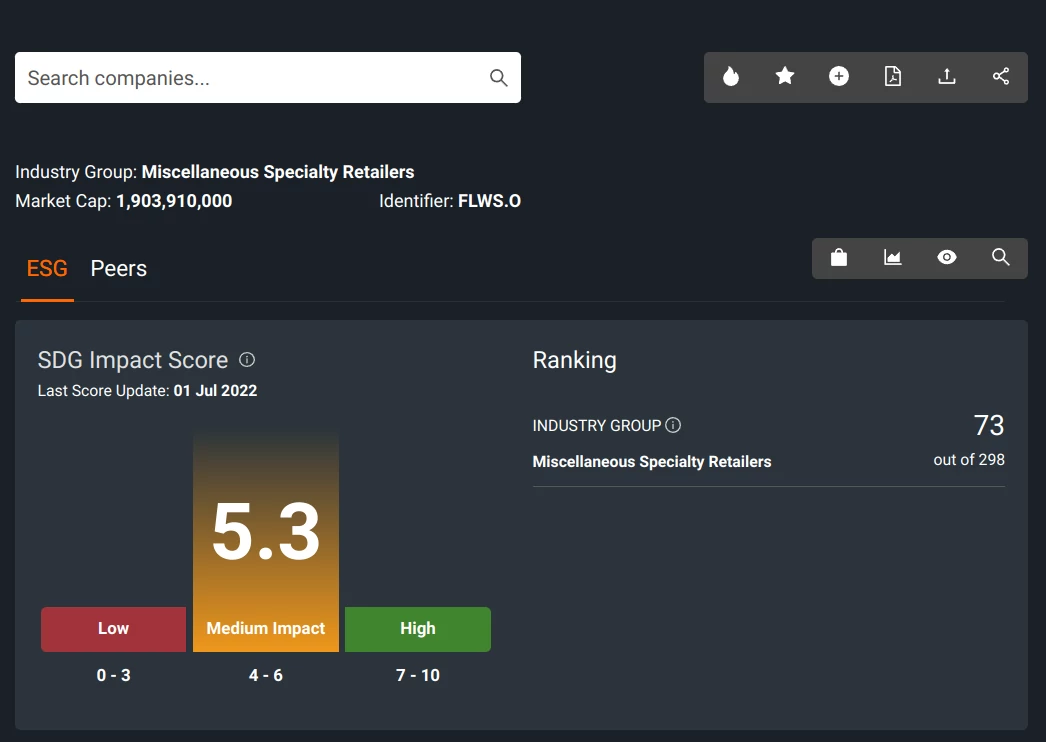

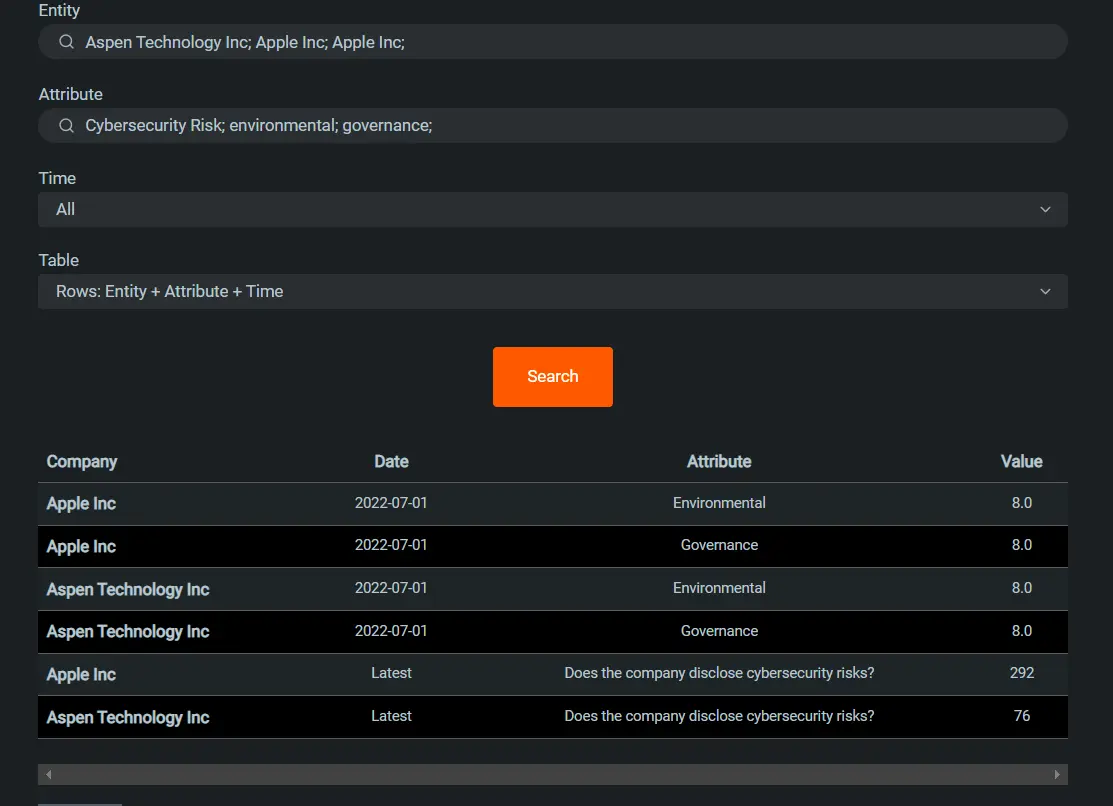

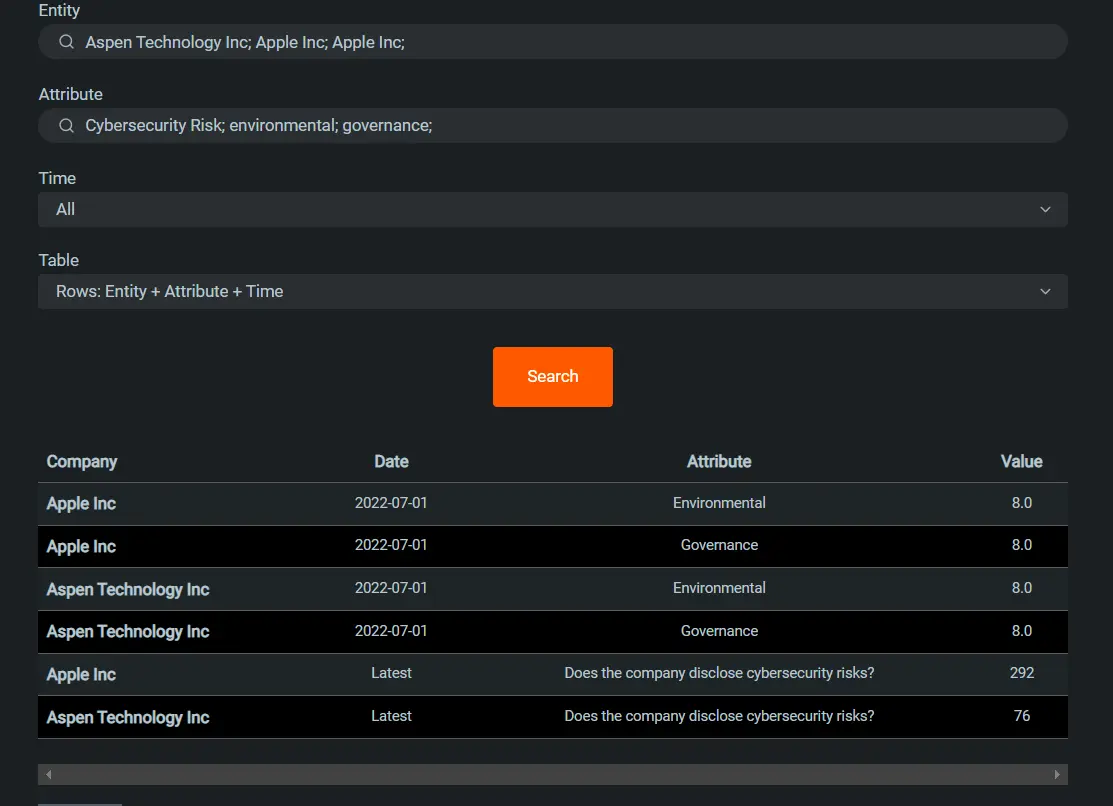

Are you an equity or fixed income investment professional seeking a streamlined approach to assessing climate governance credentials across public companies and private fixed income issuers? The Portfolio Climate Governance Agent enables investment professionals to instantly view Climate Governance credentials for any public company and tens of thousands of private fixed income issuers. The application provides a real time scoring system from 0 to 5 based on 13 widely accepted factors assessing the strength of a company’s climate transition plans. Users can access the results through an easy-to-navigate interface or directly via API to their in-house systems. This advanced tool not only optimises your workflow but also significantly extends the range of securities and data points you can cover.

Available Features:

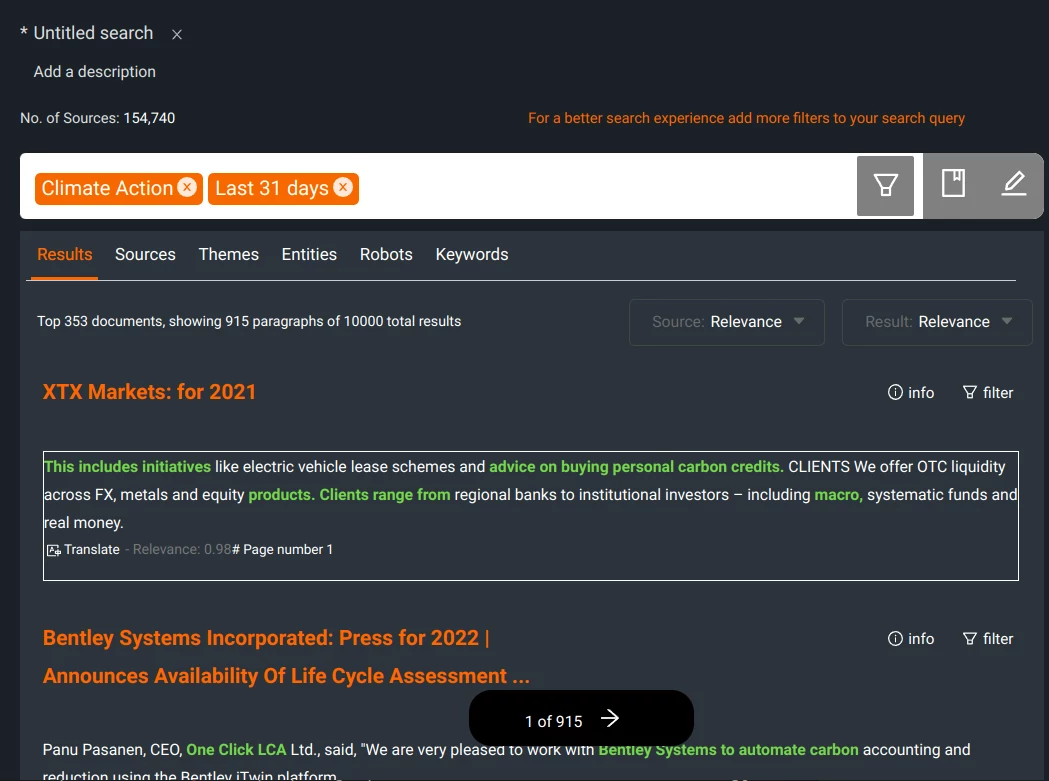

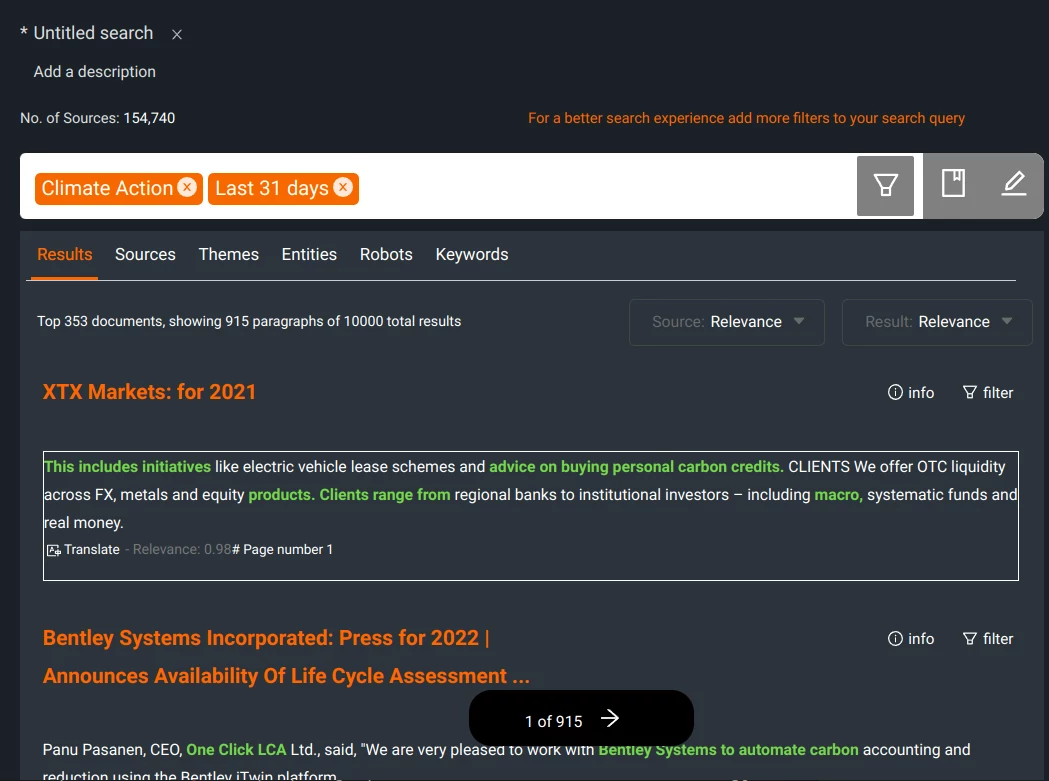

Automated Data Extraction: Drawing from primary data sources and a vast data lake enriched with over 2 trillion AI inferences.

Scoring System: Real-time scoring from 0 to 5 based on 13 universally recognised factors to gauge the robustness of a company's climate transition strategies.

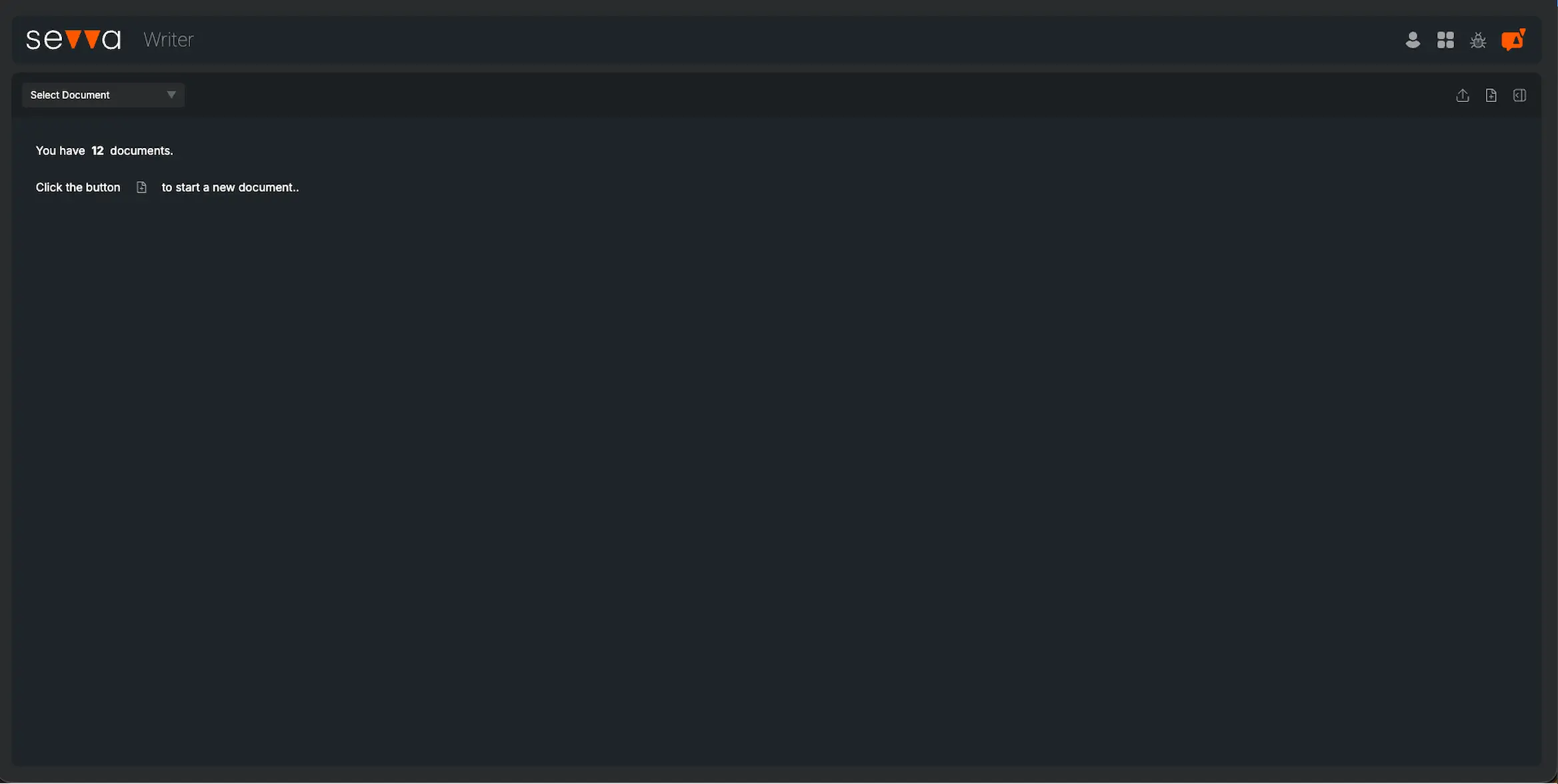

Clear Audit Trails: Assurance of traceability for every data point back to its originating source with detailed paragraph accuracy.

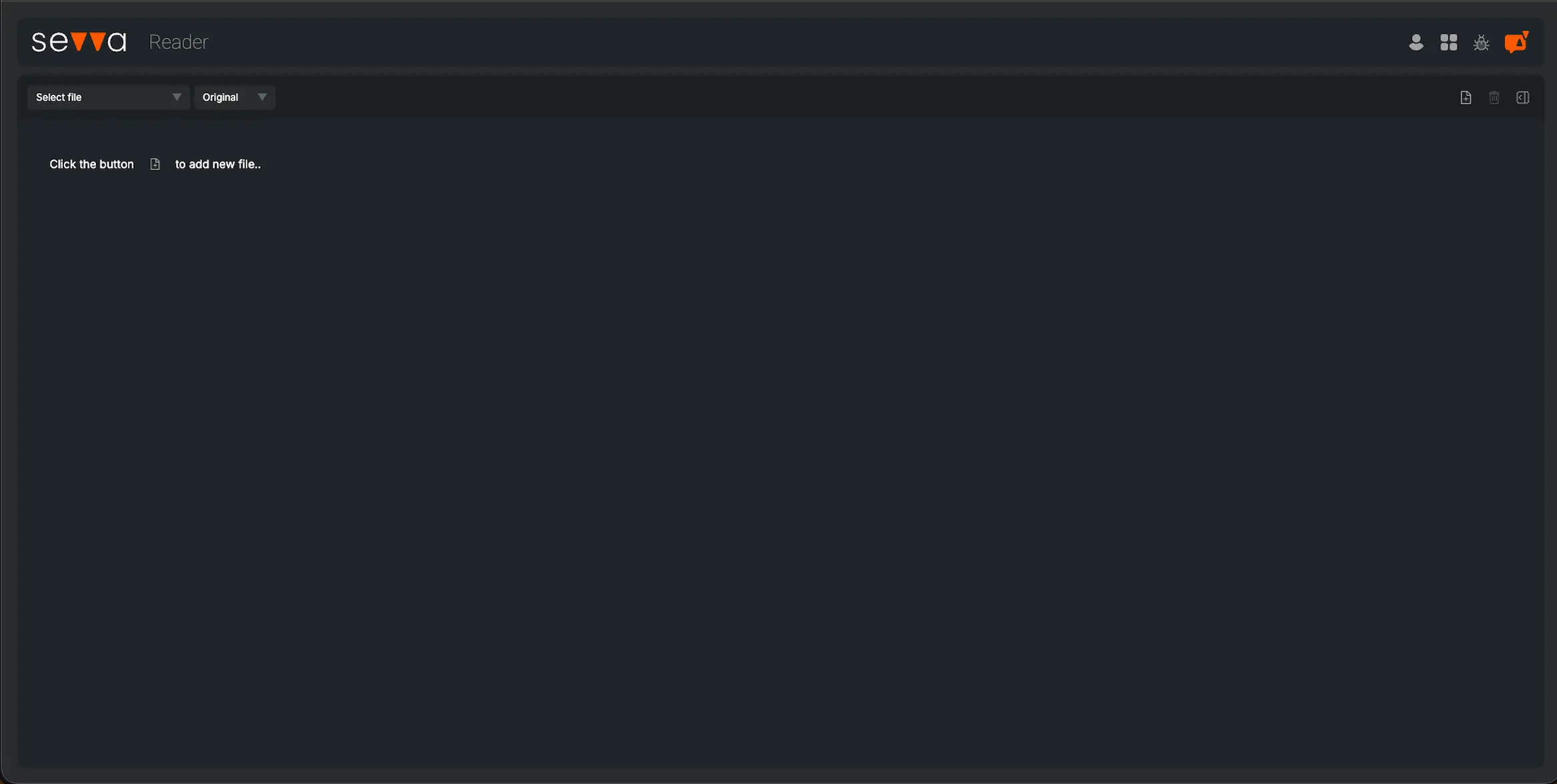

Universal Application: Comprehensive data covering all 70,000 listed companies, and tens of thousands of fixed income issuers regardless of the language of their disclosures.

API Availability: Immediate and smooth data access through API integrations.

Company and Portfolio Views: Aggregate individual company governance views to get a portfolio level governance analysis.

Who is it for?

This is designed specifically for Heads of Investment Research, Investment Research Analysts, Equity Portfolio Managers, Fixed Income Portfolio Managers, Sustainability Analysts, or ESG Analyss aiming to refine their climate governance evaluation practices.

Benefits:

Robust Returns: Boost portfolio alpha by basing your investments on climate leaders.

Superior Risk Management: Identify and action portfolio holdings with risky climate profiles and scan for potential greenwashing.

Better Corporate Engagement: Drive transparent engagement on climate transition with senior management at portfolio holdings.

Boosted Efficiency: Reallocate valuable time with the elimination of manual data retrieval processes.

Informed Decision-Making: Base your investments on clear insights into corporate climate governance.

Up-to-date Insights: Harness the most recent and comprehensive climate governance data available.

Competitive Positioning: Maintain a strategic vantage point with extensive and diverse data access.

Gallery

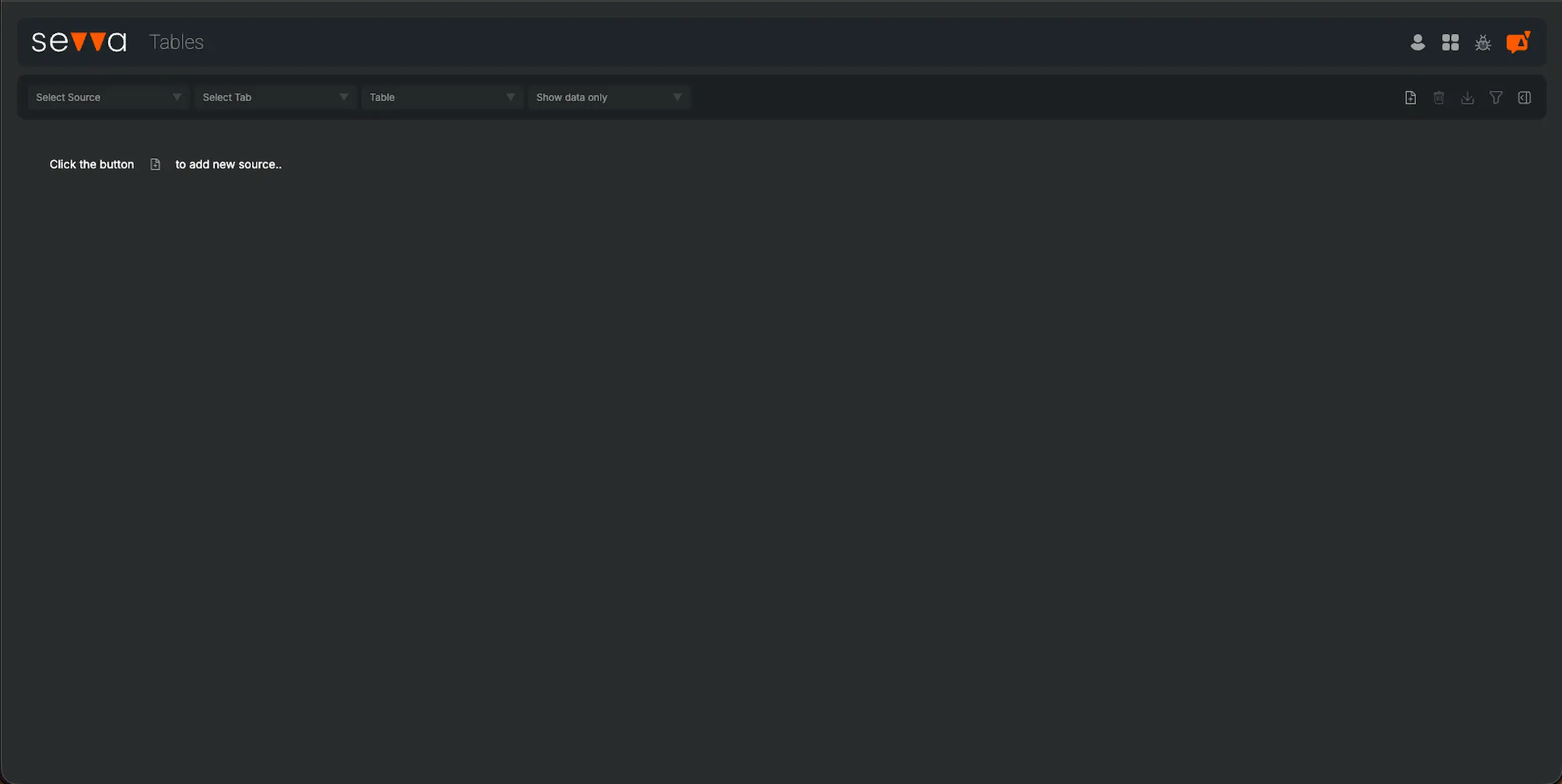

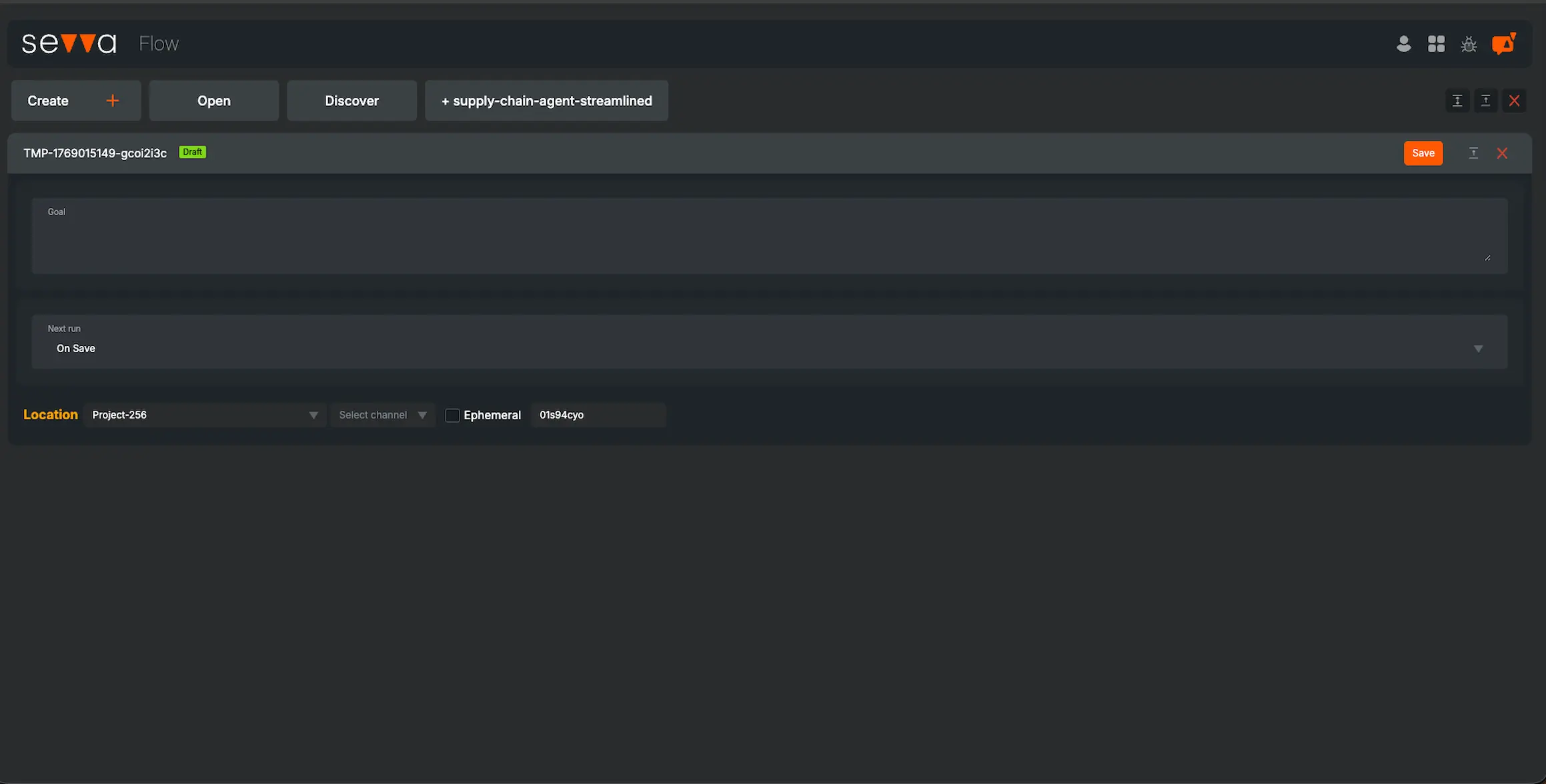

- Optimise Climate Governance Analysis Workflow

- Transparent Audit Processes

- Comprehensive Data across Global Capital Markets