Fixed Income Research Agent

Streamlining Climate Governance Analysis with Efficient Automation and Data-Centric Understanding.

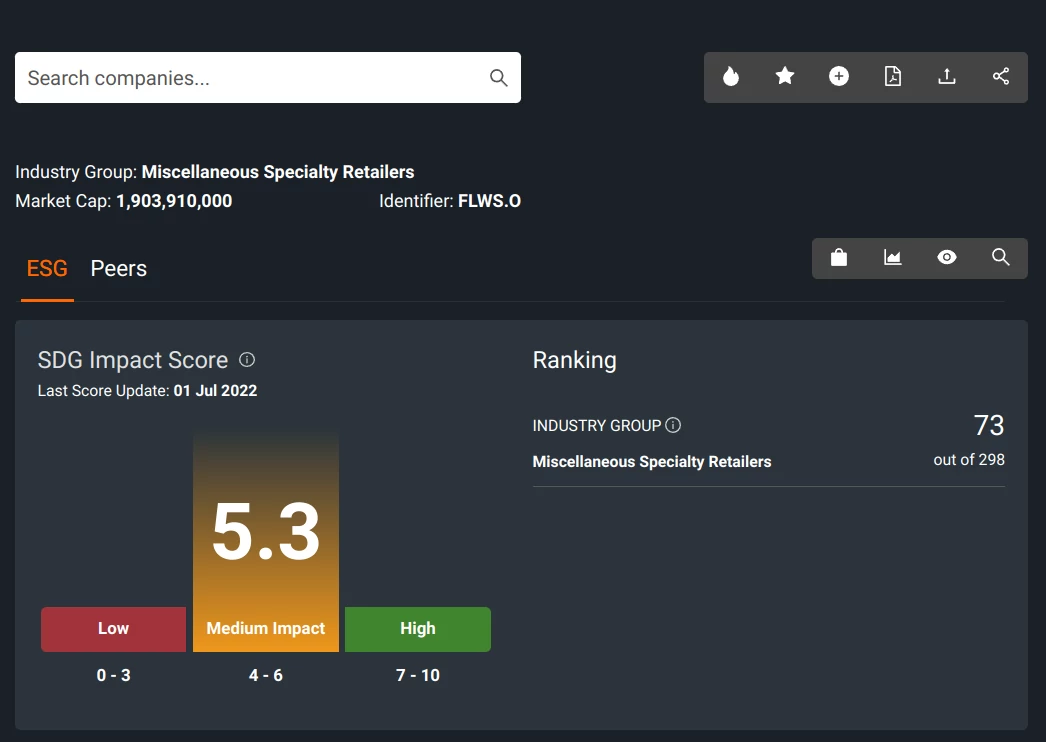

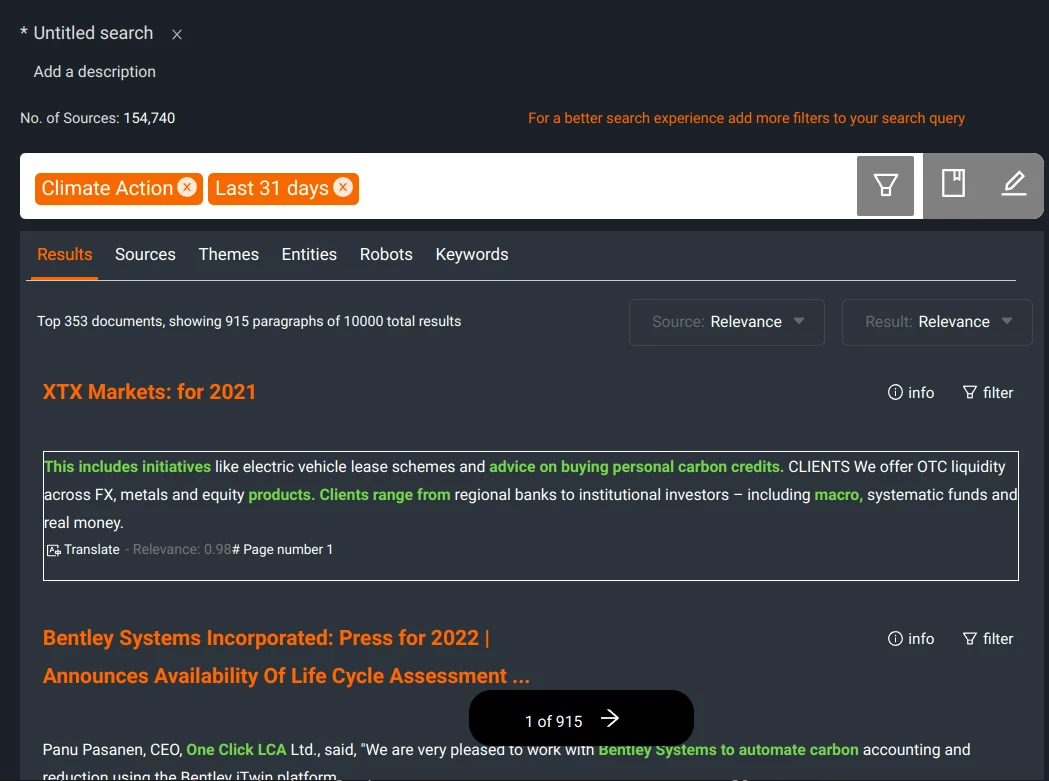

Are you a fixed income investment professional seeking a streamlined approach to assessing key investment credentials across the universe of public and private fixed income issuers? The Fixed Income Research Agent enables investment professionals to instantly view a number of research criteria extracted from bond prospectuses, annual reports, sustainabibility reports and other corporate disclosures for any public company and any private fixed income issuer extracted from. Users can access the results through an easy-to-navigate interface or directly via API to their in-house systems. This advanced system not only optimises your workflow but also significantly extends the range of securities and data points you can cover.

Available Features:

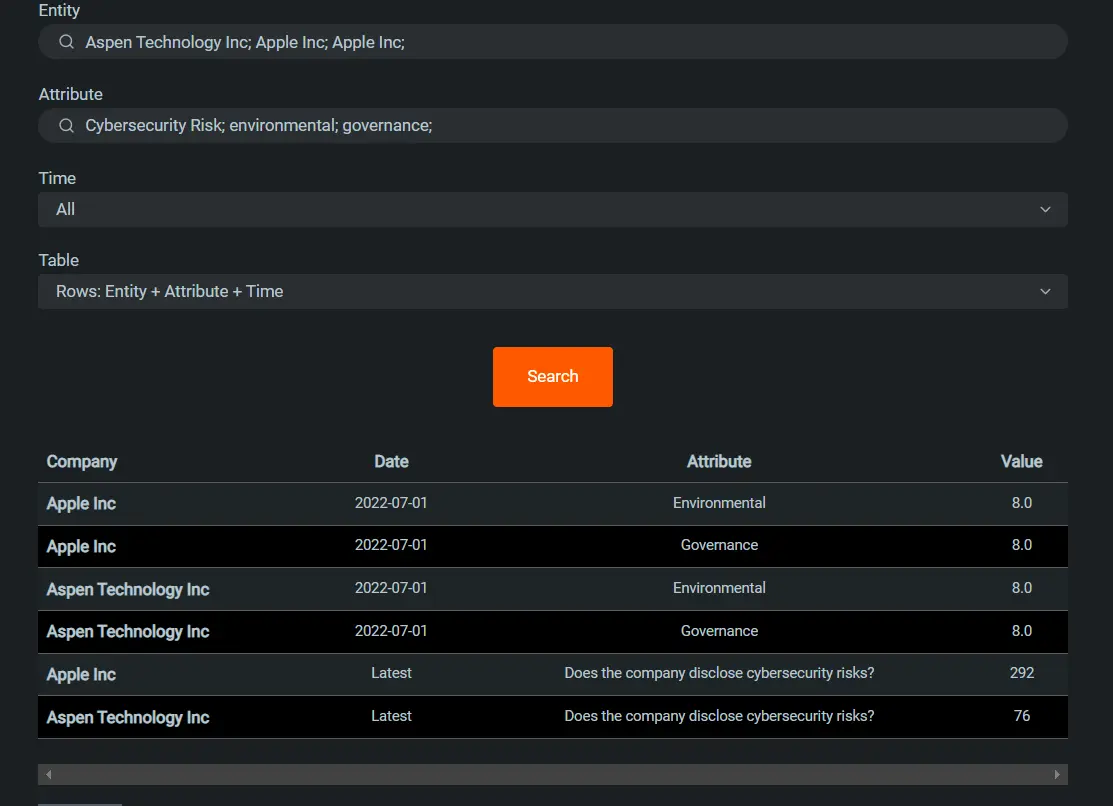

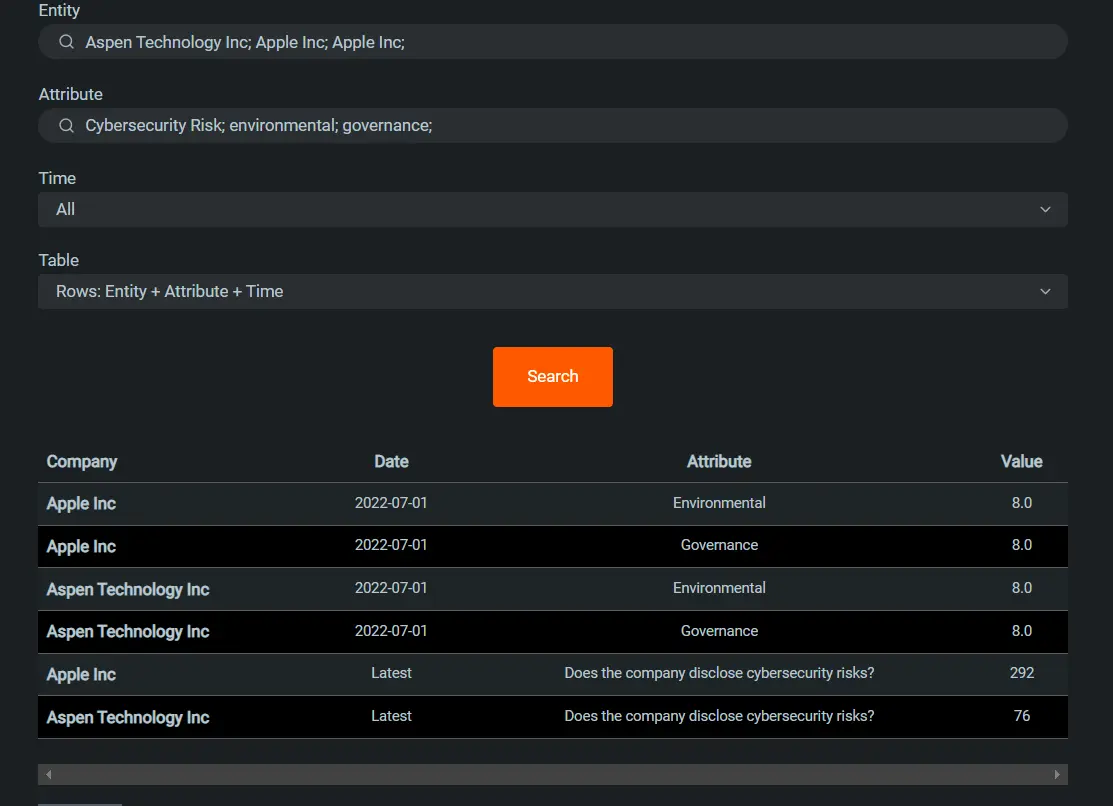

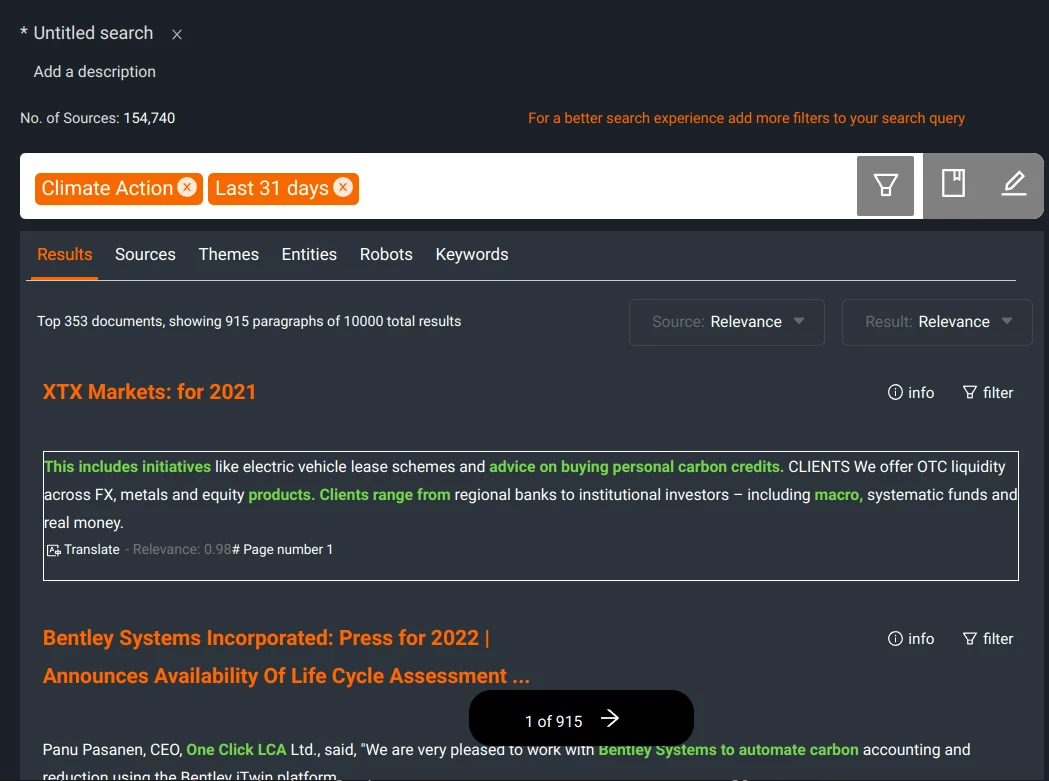

Automated Data Extraction: Drawing from primary data sources and a vast data lake enriched with over 2 trillion AI inferences.

Universal Application: Comprehensive data covering all 70,000 listed companies and any private fixed income issuer, regardless of the language of their disclosures.

Clear Audit Trails: Assurance of traceability for every data point back to its originating source with detailed paragraph accuracy.

API Availability: Immediate and smooth data access through API integrations.

Company and Portfolio Views: Aggregate individual company governance views to get a portfolio level governance analysis.

Who is it for?

This is designed specifically for Heads of Investment Research, Fixed Income Portfolio Managers, Credit Analysts, and Risk Management Professionals aiming to enhance their evaluation of governance and financial health across issuers.

Benefits:

Boosted Efficiency: Reallocate valuable time with the elimination of manual data retrieval processes.

Informed Decision-Making: Base your investments on clear insights into corporate governance and financial robustness.

Up-to-date Insights: Access the most recent and comprehensive data from key corporate disclosures.

Competitive Positioning: Maintain a strategic vantage point with extensive and diverse data access.

Gallery

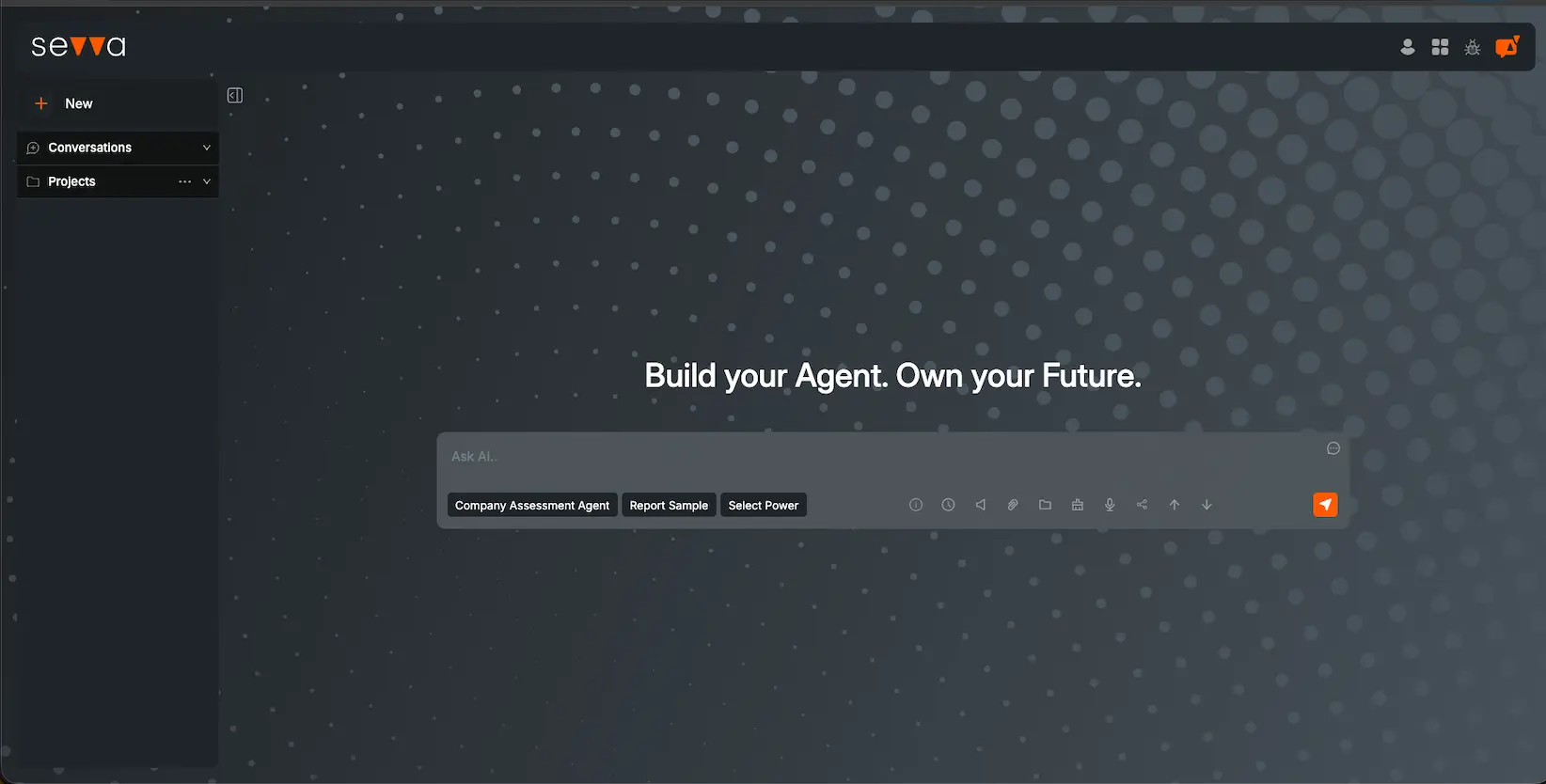

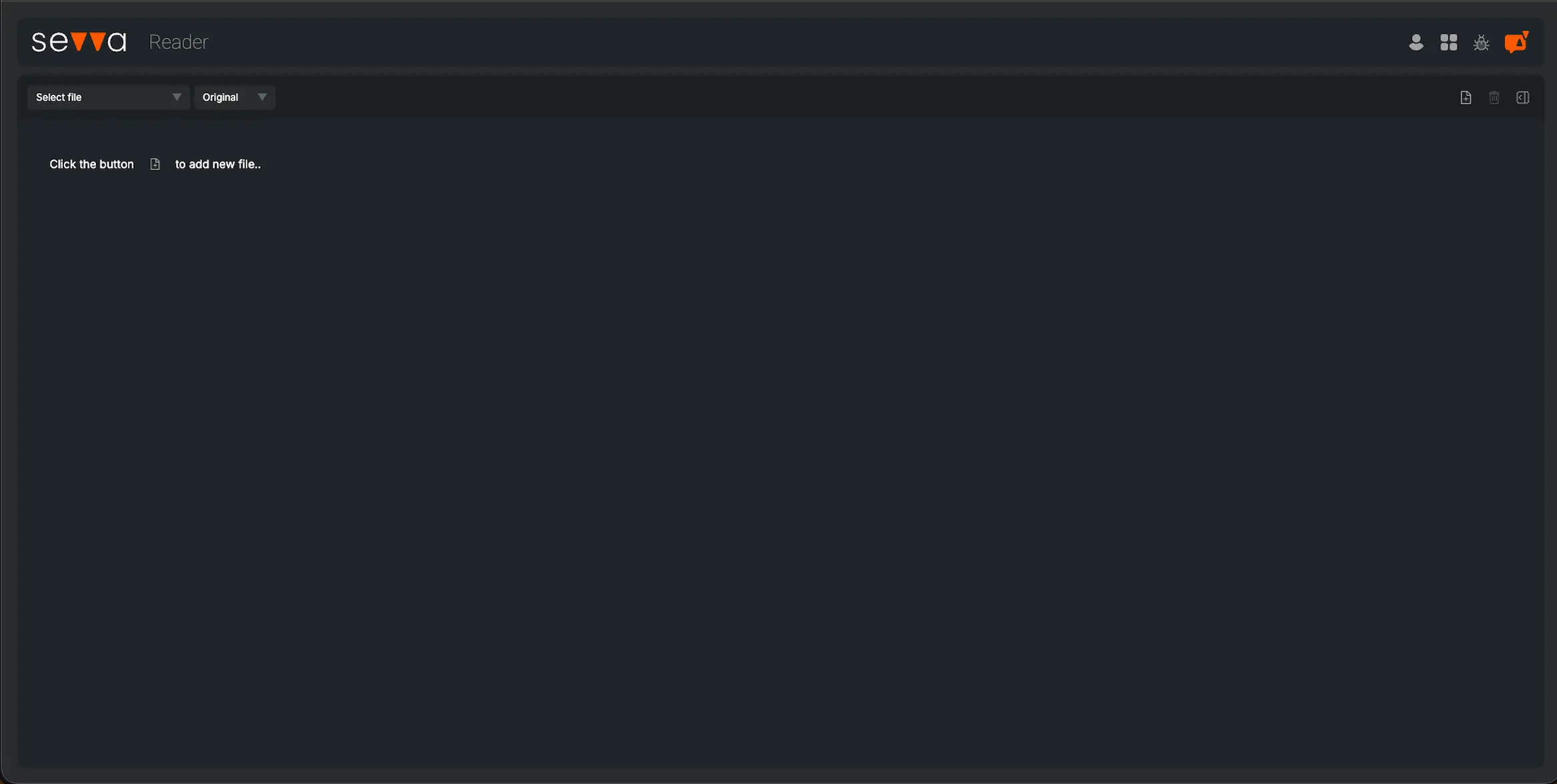

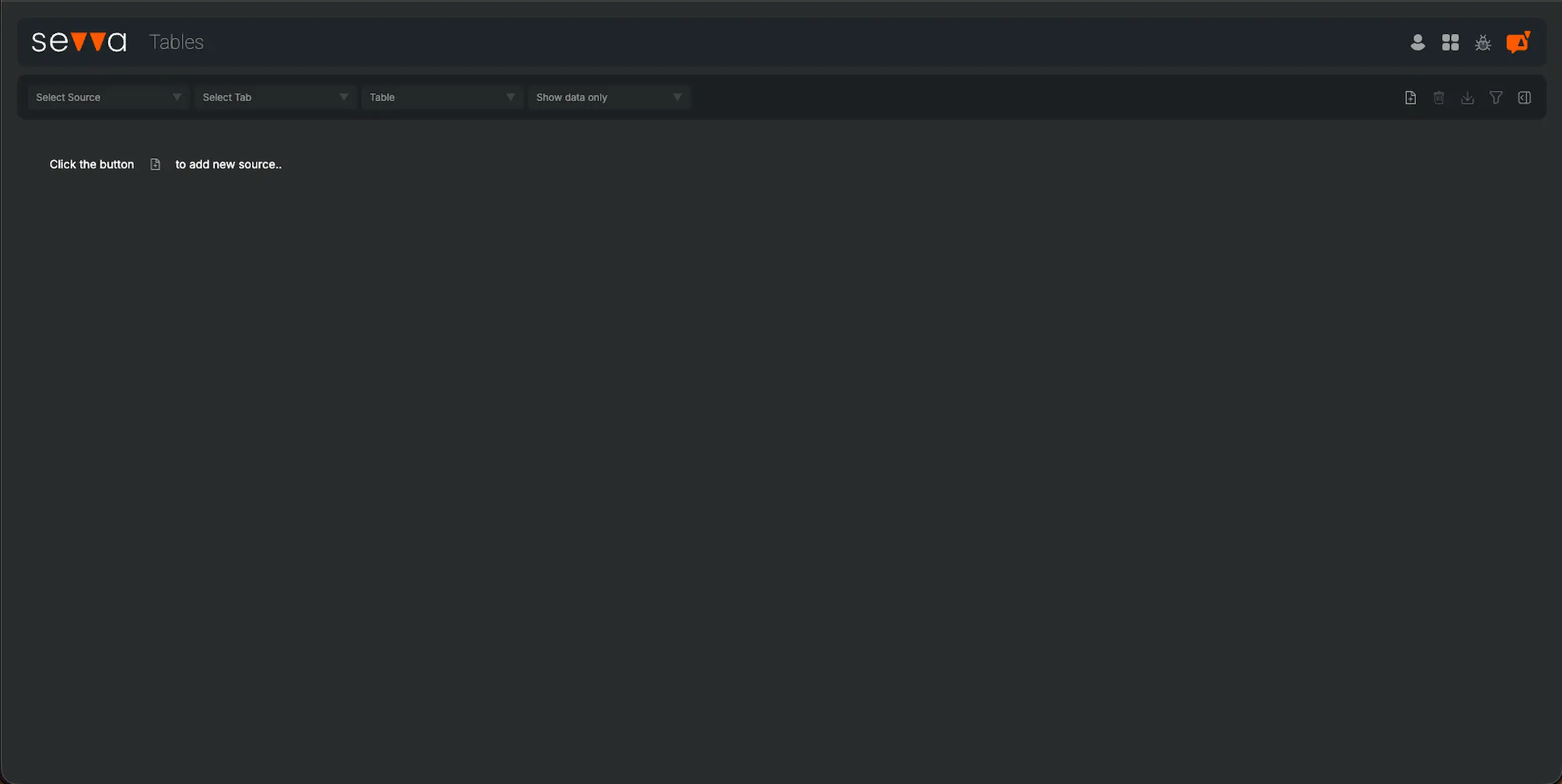

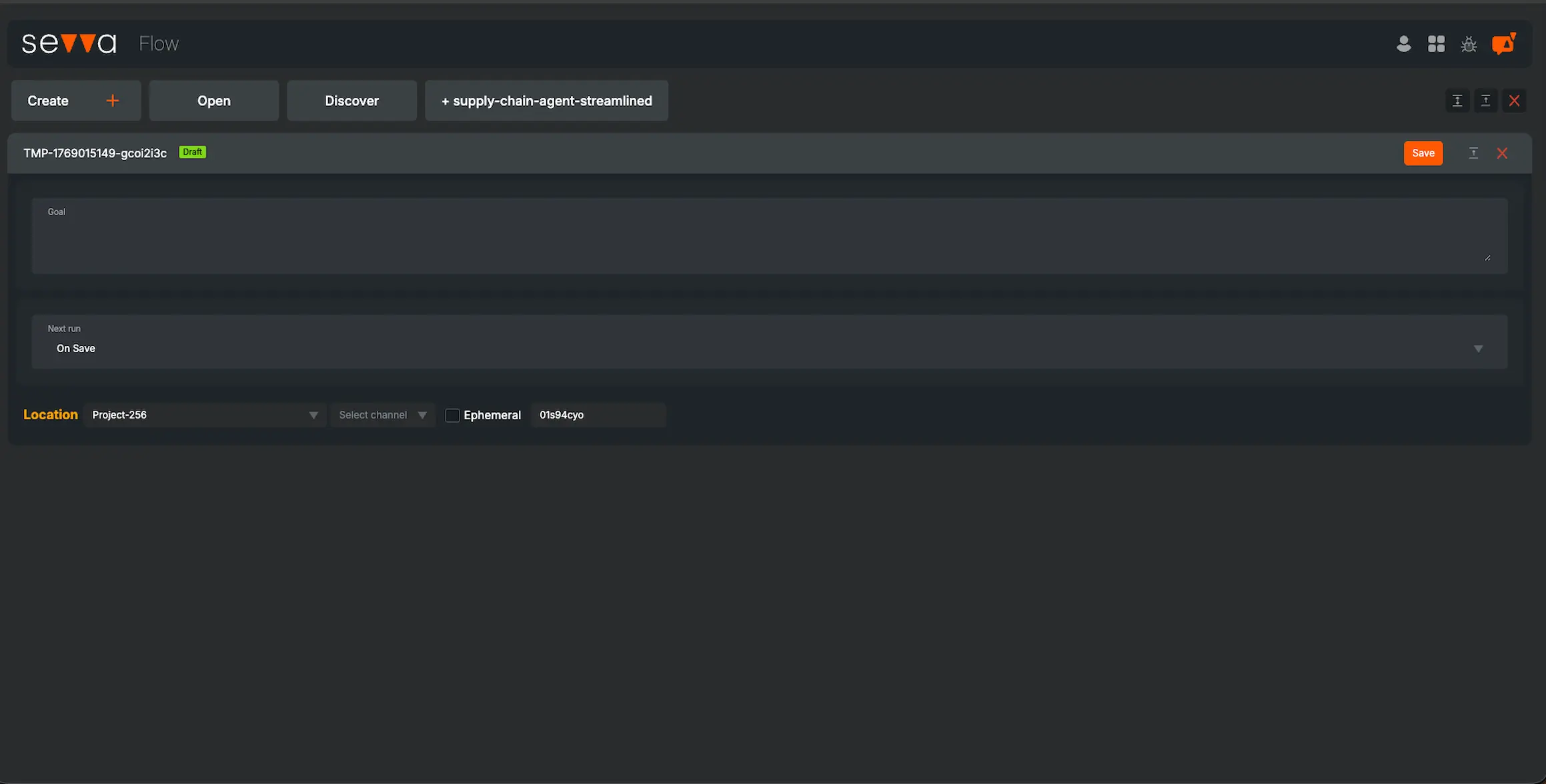

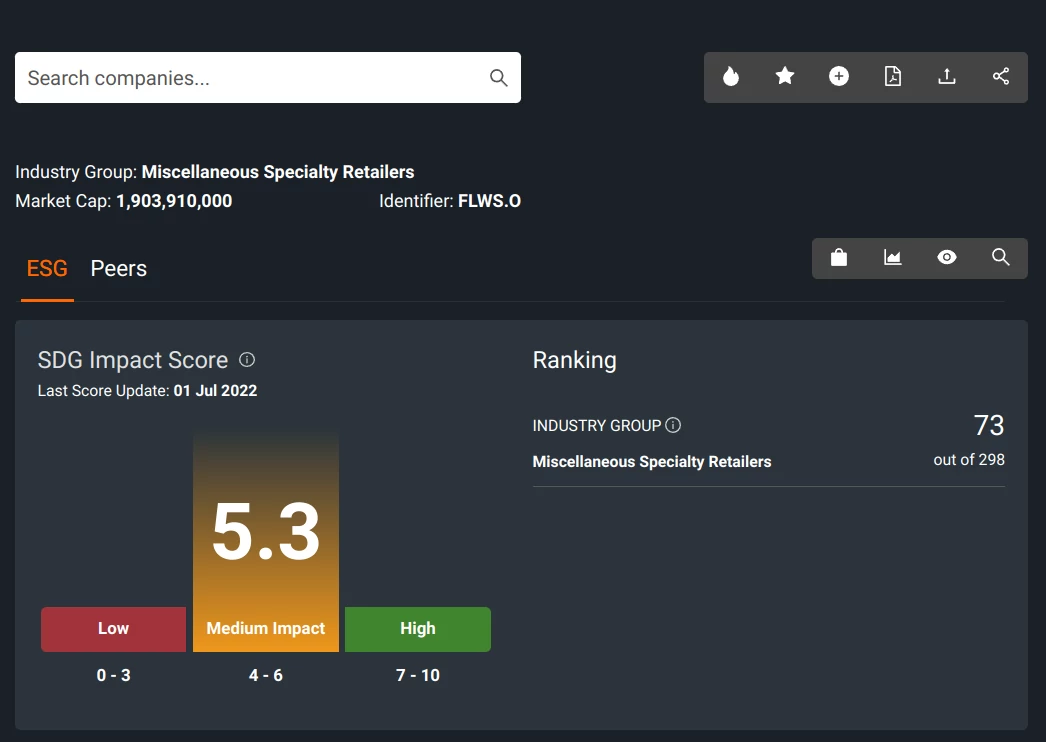

- Optimise Fixed Income Analysis Workflow

- Transparent Audit Processes

- Comprehensive Data across Global Capital Markets