Net Zero Forecasting Agent

Empowering Investment Decisions with Advanced Net Zero Projections and Carbon Governance Analysis.

- Instant Net Zero Forecasting

- Comprehensive Emissions Data

- Streamlined Carbon Risk Evaluation

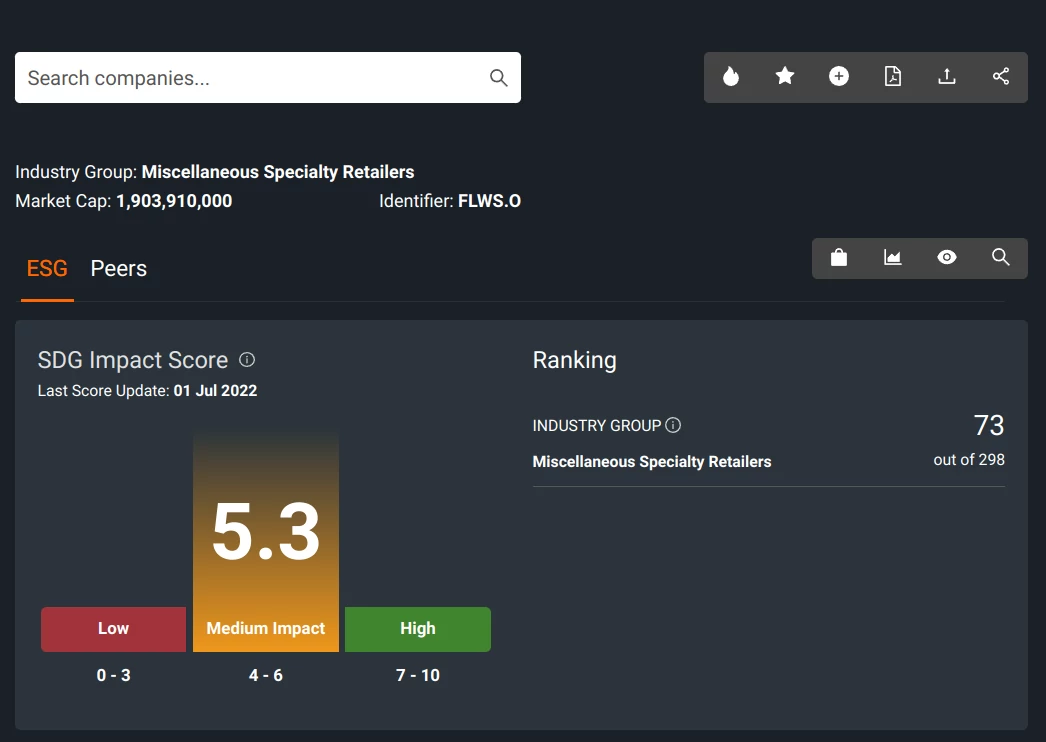

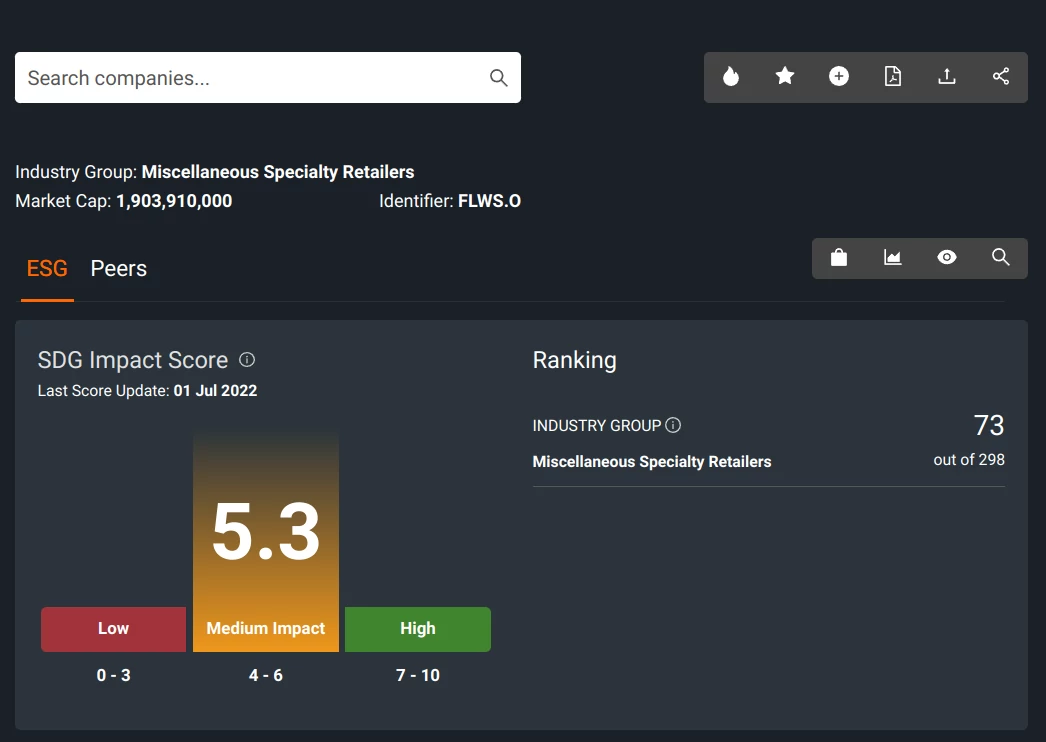

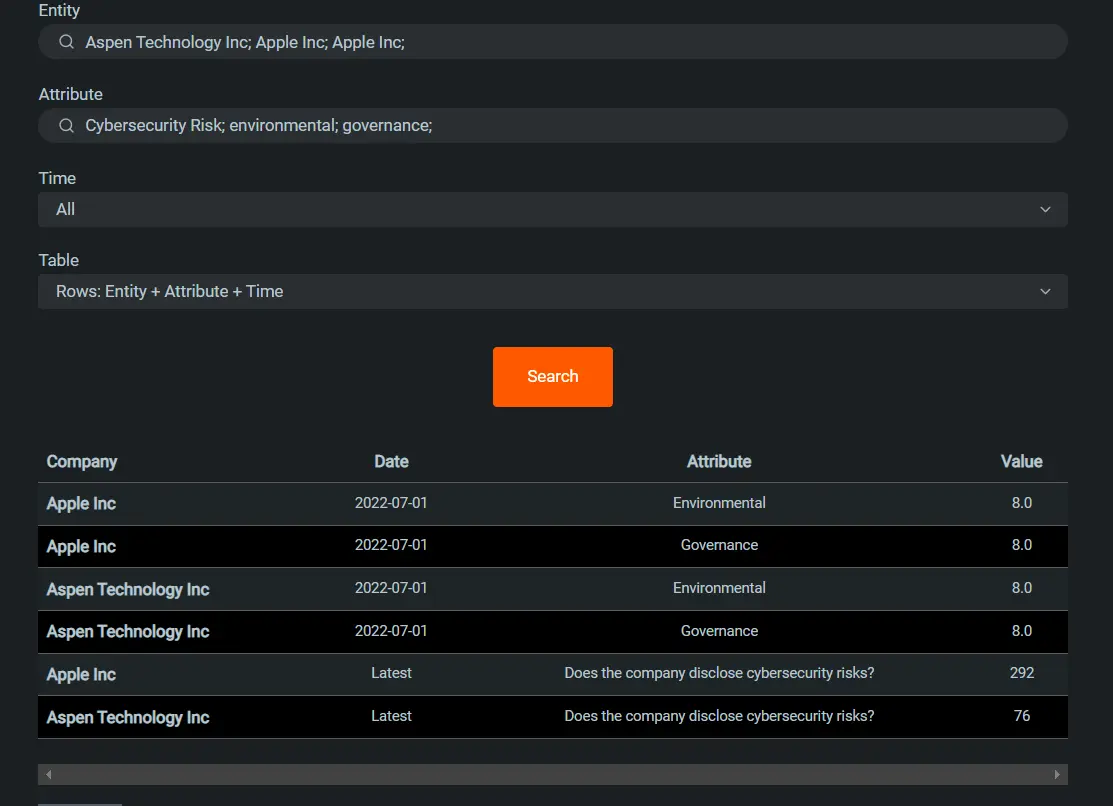

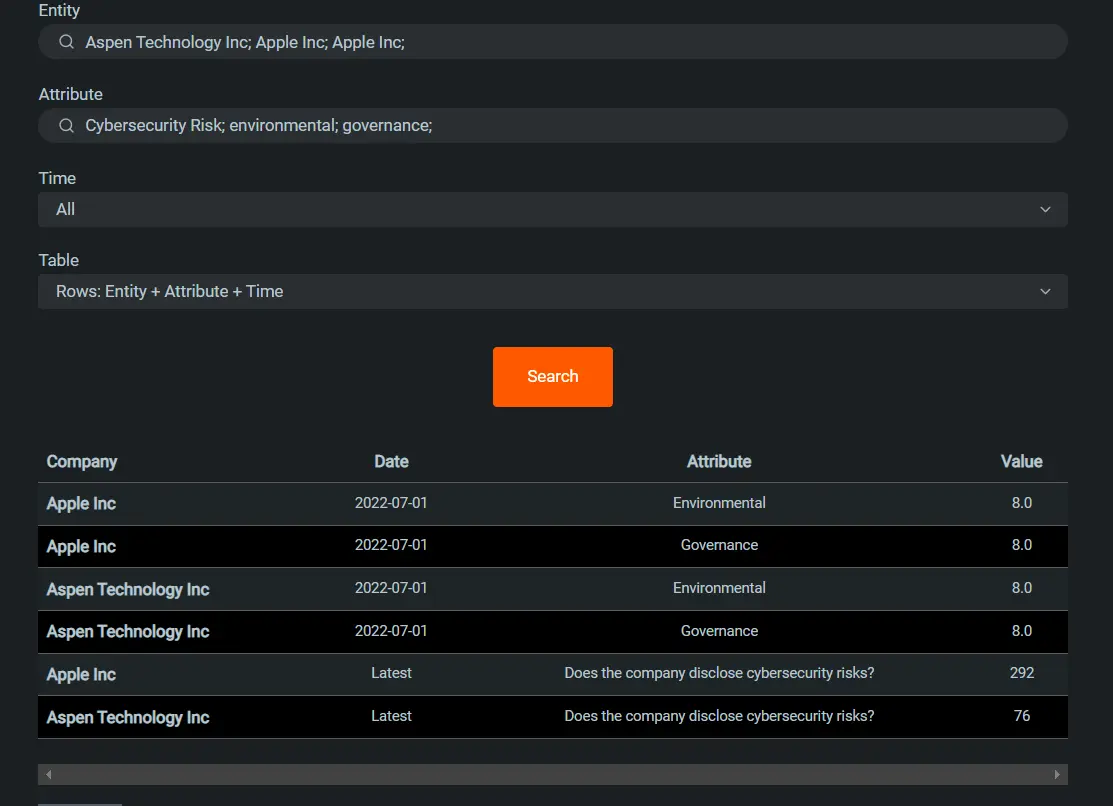

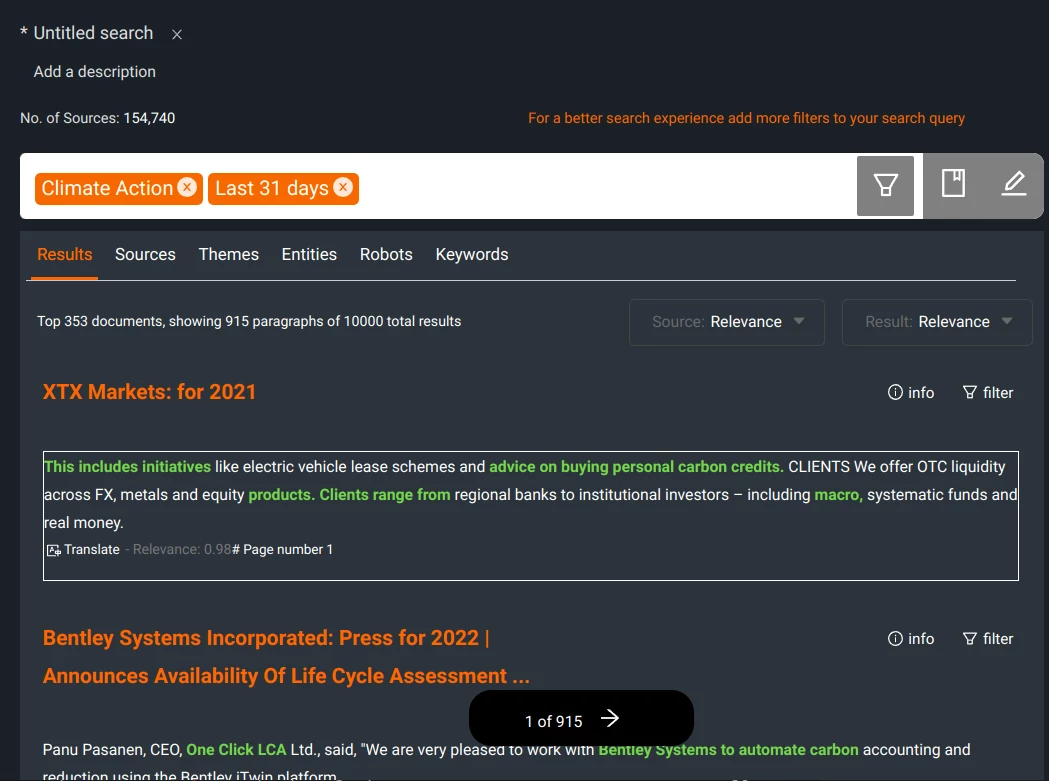

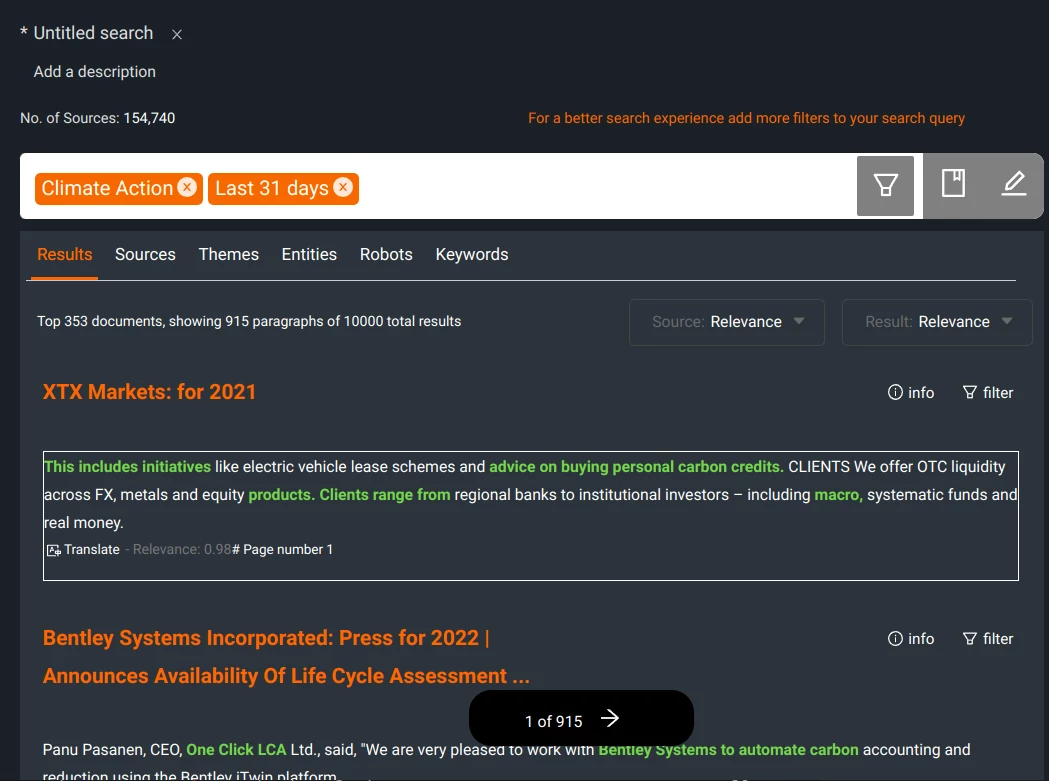

The Net Zero Forecasting Agent provides you with an instant view of the date on which any company is projected to hit net zero. Compare the projected date against the company’s stated net zero target to assess the credibility of its net zero targets across Scope 1,2 and 3. Projected dates are assigned a range based on the quality of the company’s carbon governance, and you can do a deep dive on carbon governance with Automated Climate Governance for Public Equities or Automated Climate Governance for Fixed Income. Aggregate your analysis to view the overall quality of the net zero commitments of your holdings. The Net Zero Date Forecaster also provides a complete set of emissions data in line with TCFD to cover your regulatory reporting requirements, including Carbon Emissions and Carbon Footprint. You can also determine the Carbon Value at Risk (Carbon VAR) of your portfolio at carbon price scenarios of $50/ton and $100/ton.

Available Features:

Proactive Net Zero Projections: Instantly ascertain when any company is likely to achieve net zero, facilitating effective comparison against their stated objectives.

Carbon Governance Deep Dive: Seamless integration with Automated Climate Governance modules for both Public Equities and Fixed Income.

Portfolio Overview: Aggregate net zero commitment assessments for a holistic view of your holdings.

Comprehensive Emissions Metrics: Fulfil your regulatory reporting obligations with complete emissions data in accordance with TCFD.

Carbon VAR Analysis: Understand the potential financial impact on your portfolio with carbon pricing scenarios.

API Integration: Ensure smooth data transmission with real-time API capabilities.

Who is it for?

Tailored for Heads of Heads of Investment Research, Investment Research Analysts, Portfolio Managers, Chief Sustainability Officers, Sustainability Analysts, and ESG Analysts aiming to elevate their insights on portfolios' and companies' climate commitments and projected net zero dates.

Benefits:

Robust Returns: Boost portfolio alpha by basing your investments on climate leaders.

Superior Risk Management: Identify and action portfolio holdings with risky climate profiles and scan for potential greenwashing.

Better Corporate Engagement: Drive transparent engagement on climate transition with senior management at portfolio holdings.

Stay Compliant: Effortlessly meet and exceed ESG regulations with up-to-date, comprehensive data.

Increase AUM: Drive more Assets Under Management (AUM) with demonstrating climate risk management best practice.

Competitive Edge: Stay ahead of the curve by covering a broader range of companies and incorporating diverse data points.

Gallery